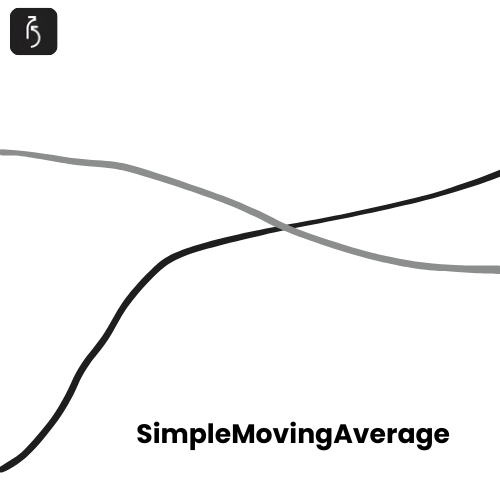

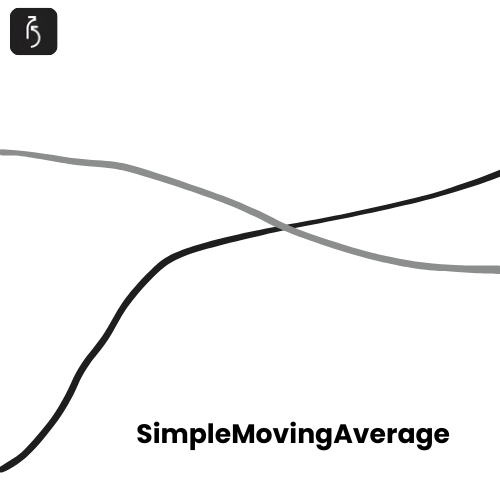

The Simple Moving Average (SMA) is a technical indicator that calculates the average price of an asset over a specific number of periods. For example, a 20-day SMA adds up the closing prices of the last 20 days and divides by 20. As new prices come in, the average “moves” forward, smoothing out short-term fluctuations and highlighting the overall trend.